25/11/2017. Voici les résultats d’un sondage sur l’e-commerce à Madagascar réalisé en novembre 2017 sur un échantillon de 2735 personnes. Ce sondage a été conduit par l’équipe Stileex. Vous êtes libre de diffuser et de reprendre le contenu de cet article, y compris les images, en contrepartie d’un lien vers cet article.

> Voir la nouvelle version 2018 de l’étude sur l’e-commerce à Madagascar

Résultat du sondage sur l’e-commerce à Madagascar

Vous pouvez télécharger la version PDF de cette étude sur l’e-commerce à Madagascar en cliquant ici.

Analyse du sondage sur la vente en ligne à Madagascar

Les non-consommateurs

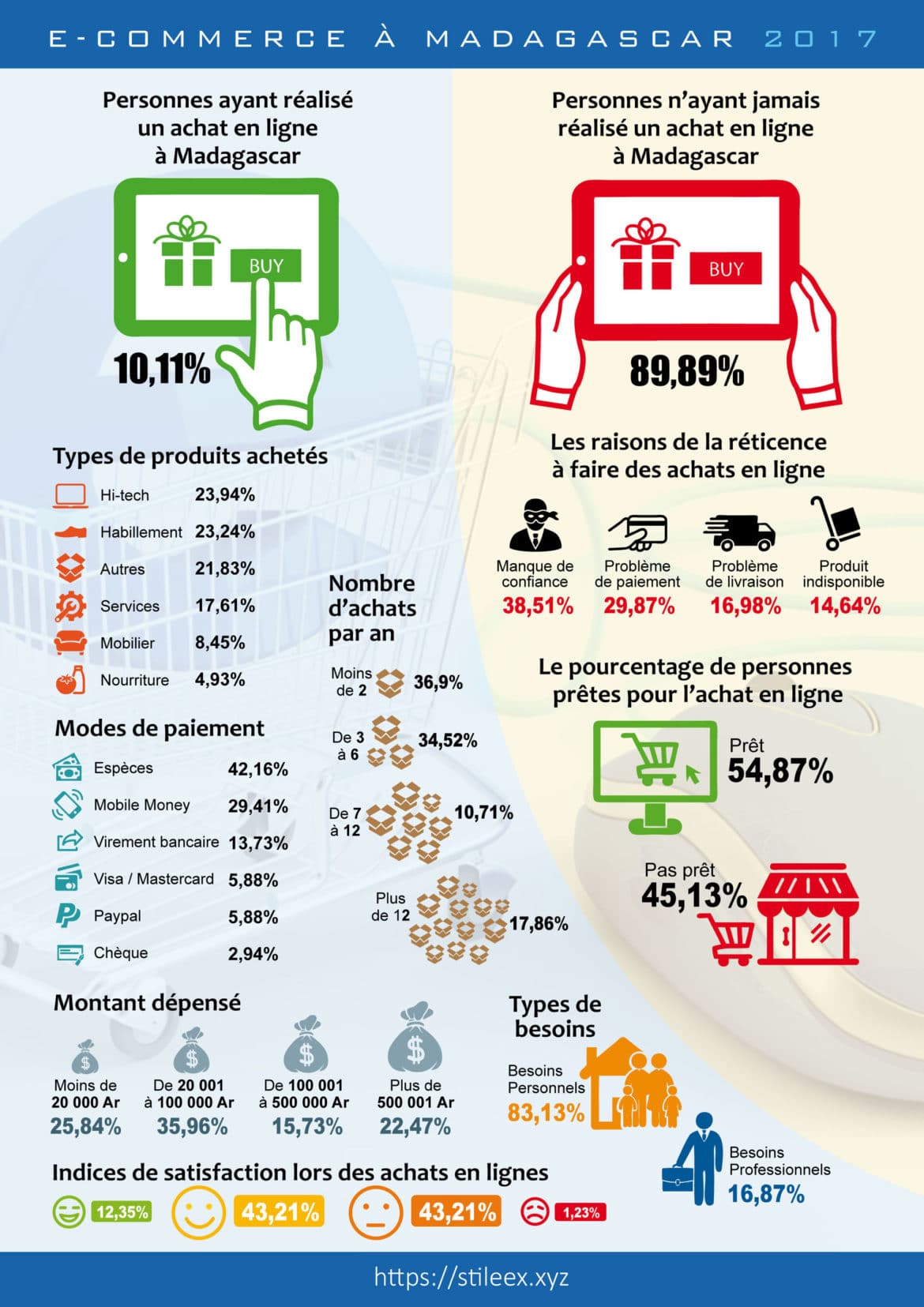

On se rend compte après cette étude que la vente en ligne à Madagascar est encore peu développée. Une personne sur 10 seulement déclare avoir déjà effectué un achat en ligne à Madagascar.

Les deux problèmes majeurs qui freinent le développement du commerce en ligne à Madagascar est le manque de confiance des consommateurs (38%) et les problèmes de paiement à distance (30%).

Internet, un service encore peu démocratisé

En effet, le taux de pénétration d’Internet à Madagascar est encore beaucoup trop faible : 5,4% selon une étude publiée par l’ARTEC (Autorité de Régulation des Technologies de Communication) en 2015. Ce faible taux de pénétration s’explique facilement par les prix rédhibitoires pratiqués par les fournisseurs d’accès à Internet malgaches, lesquels augmentent d’année en année. Il faut savoir qu’une connexion ADSL coûte plus cher que le salaire moyen national…

Pas étonnant que l’économie numérique ne soit pas encore rentrée dans mœurs dans la Grande Île. Il faut aussi souligner qu’il n’existe pas de e-commerçants dominant à Madagascar, la plupart des acheteurs en ligne passant par Facebook. Il n’y a donc pas de leader du secteur pour donner l’impulsion vers le développement soutenu du e-commerce.

Les paiements à distance

Les problèmes de paiement viennent en second lieu. Le taux de bancarisation est très faible à Madagascar. En 2016 moins de 4% de la population possèdent un compte bancaire selon la Banque Centrale.

Donc oubliez les paiements en ligne avec une carte Visa ou Mastercard. Il faut se tourner vers le mobile banking pour les paiements à distance. À ce sujet, je vous renvoie à une précédente étude qui a été effectuée en début 2017 sur le mobile money à Madagascar. Selon ce sondage, 87% des personnes interrogées déclarent avoir un compte Mvola, Orange money ou Airtel money.

Le mobile banking est encore peu adapté à la vente en ligne, malgré les efforts de certains opérateurs pour développer des API (des sortes de programmes) pour faire communiquer leur service avec les boutiques en ligne. À noter qu’un opérateur, Orange, fait même payer l’achat de son API aux e-commerçants… Ce qui évidemment ajoute un frein supplémentaire au développement du e-commerce à Madagascar.

La bonne nouvelle : plus de la moitié (55%) des personnes qui n’ont jamais fait d’achat en ligne se disent prêtes à sauter le pas !

Les produits les plus achetés sur Internet

Sans surprise, les produits hi-tech (téléphones, matériels informatiques, etc.) et le prêt-à-porter dominent le marché de la vente en ligne, avec respectivement 23,94% et 23,24% des parts.

Ce n’est pas très étonnant vu la quantité de vendeurs en ligne sur Facebook qui proposent ces produits.

Viennent ensuite les services (comme les hébergements web Simafri), le mobilier (avec notamment l’acteur principal sur ce segment bonmarche.mg) et la nourriture.

83,13% des produits et services achetés sur Internet concernent des besoins personnels, contre 16,87% pour les dépenses professionnelles.

Fréquence et panier moyen d’achat

Les achats sur Internet à Madagascar sont réalisés de manière très sporadique : moins de 2 achats en ligne par an pour 36,9% des personnes qui ont déjà acheté en ligne. Les personnes qui achètent moins de 6 fois par an, soit moins d’une fois tous les deux mois, représentent tout de même plus des 2/3 des personnes interrogées (71,42%).

Cette faible fréquence d’achat ne peut d’ailleurs pas s’expliquer par une mauvaise expérience client car plus de la moitié des consommateurs sur Internet déclarent être satisfaits ou très satisfaits par le service des e-commerçants. 43,21% des personnes interrogées disent avoir vécu une expérience passable et seulement 1,23% regrettent d’avoir acheté sur Internet.

Quant au montant moyen des paniers d’achat, il est assez uniforme, avec une prédominance pour la tranche de dépenses allant de 20 000 à 100 000 Ar. À noter que les achats sur Internet dépassant les 500 000 Ar sont assez répandus à Madagascar.

Modes de paiement les plus utilisés pour le e-commerce

Comme on l’a vu précédemment, le taux de bancarisation à Madagascar est très faible. Donc, sans surprise, les paiements avec une carte Visa/Mastercard et via des services comme Paypal sont peu utilisés, avec moins d’une personne sur 10.

De même, le fait que près d’un tiers (29,42%) des personnes interrogées déclarent utiliser le mobile banking pour payer leurs achats en ligne n’a rien de surprenant.

Par contre, ce qui est remarquable est que le mode de paiement le plus utilisé à Madagascar pour l’e-commerce est… les espèces! Ce mode de paiement est privilégié par 42,16% des personnes sondées. C’est dire le retard technologique de l’économie numérique dans la Grande Île.

La prédominance du paiement en espèces peut s’expliquer par le manque de confiance dans les paiements à distance à Madagascar, mais également par des plateformes de vente pas assez évoluées (comptes Facebook, site web sans gestion de panier, etc.).

À noter que les e-commerçants commencent à rendre leur activité plus automatisée en utilisant des ERP de gestion des ventes Openflex comme par exemple e-Tsena ou J’ShoOpin.

En conclusion

Je suis persuadé que l’e-commerce à Madagascar n’en est encore qu’à ses balbutiements, et qu’il a un grand avenir devant lui. J’ai d’ailleurs déjà eu moi-même une expérience concrète dans ce domaine et je considère la vente en ligne comme un moyen efficace de gagner de l’argent à Madagascar.

Cependant, pour réussir, il faut que les e-commerçants s’en donnent les moyens : boutique en ligne sans bug, esthétique et bien référencé, logiciel d’automatisation des processus comme l’excellent Openflex, marketing plus élaboré, utilisation d’outils de gestion comme un logiciel CRM, un vrai monitoring des KPI liés au web, etc.

Je pense également qu’il n’est pas obligatoire de suivre le cheminement qu’a connu la vente en ligne en Europe. Par exemple, orienter sa stratégie vers la vente sur mobile avant même la vente via un site web peut s’avérer plus innovant, efficace et plus adapté aux marchés émergents.

Le développement du e-commerce à Madagascar doit aussi passer par une démocratisation de l’Internet, donc une baisse des prix pratiqués par les FAI…

Mode opératoire de cette étude

Ce sondage a été réalisé en ligne sur un échantillon de 2735 personnes se répartissant de la manière suivante :

| Genre | Pourcentage |

|---|---|

| Femme | 45,36% |

| Homme | 54,64% |

| Âge | Pourcentage |

|---|---|

| Moins de 18 ans | 6,00% |

| Entre 18 et 25 ans | 25,39% |

| Entre 26 et 35 ans | 27,76% |

| Entre 36 et 45 ans | 21,65% |

| Entre 46 et 60 ans | 13,39% |

| Plus de 60 ans | 5,81% |

| Ville de résidence | Pourcentage |

|---|---|

| Antananarivo | 58,87% |

| Majunga | 8,83% |

| Tamatave | 8,11% |

| Fianarantsoa | 7,56% |

| Antsirabe | 6,13% |

| Tuléar | 4,30% |

| Diego Suarez | 3,34% |

| Autre | 2,86% |

Très intéressant, merci beaucoup.

Très intéressant. Merci

Très instructive surtout que je me lance dans la vente en ligne. Je dois donc éduquer mes consommateurs… C bcp de boulots!